| Item | 2019/3 | 2020/3 | 2021/3 | 2022/3 | 2023/3 | ||

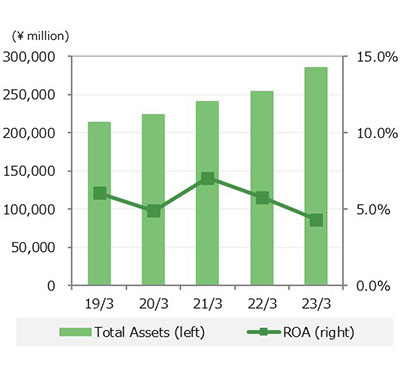

| Scale | Total Assets | 213,786 | 223,128 | 240,211 | 254,178 | 285,592 | |

| Total Fixed Assets | 114,542 | 119,445 | 124,677 | 136,045 | 162,928 | ||

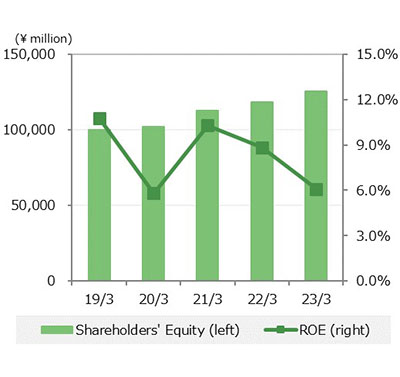

| Shareholders' Equity | 99,830 | 101,889 | 112,620 | 118,269 | 125,496 | ||

| Profitability | Gross Income on Net Sales | 57.1% | 58.4% | 58.9% | 58.7% | 59.2% | |

| Return on Net Sales | *1 | 5.8% | 3.3% | 5.3% | 4.6% | 3.5% | |

| Selling and General Expenses on Net Sales | *2 | 50.3% | 52.7% | 51.2% | 52.5% | 53.9% | |

| ROE | *3 | 10.8% | 5.8% | 10.3% | 8.8% | 6.1% | |

| ROA | *4 | 6.1% | 4.9% | 7.1% | 5.8% | 4.3% |

| Item | 2019/3 | 2020/3 | 2021/3 | 2022/3 | 2023/3 | ||

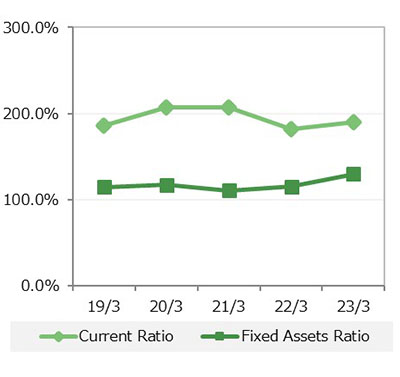

| Stability | Current Ratio | *5 | 185.6% | 206.8% | 207.6% | 182.0% | 189.9% |

| Fixed Assets Ratio | *6 | 114.7% | 117.2% | 110.7% | 115.0% | 129.8% | |

| Long-term Conformity Ratio | *7 | 71.8% | 69.3% | 67.8% | 72.2% | 74.0% | |

| Shareholders' Equity Ratio | *8 | 46.7% | 45.7% | 46.9% | 46.5% | 43.9% | |

| Step Current Ratio | *9 | 1.4 | 1.4 | 1.8 | 1.6 | 1.8 | |

| Debt Ratio | *10 | 27.9% | 30.4% | 26.1% | 28.9% | 37.0% |

| Item | Unit | 2019/3 | 2020/3 | 2021/3 | 2022/3 | 2023/3 | ||

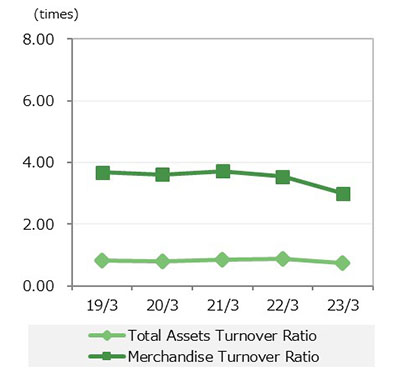

| Efficiency | Total Assets Turnover Ratio | times | *11 | 0.8 | 0.8 | 0.9 | 0.9 | 0.7 |

| Merchandise Turnover Ratio | times | *12 | 3.7 | 3.6 | 3.7 | 3.5 | 3.0 |

| Item | Unit | 2019/3 | 2020/3 | 2021/3 | 2022/3 | 2023/3 | ||

| Productivity | Productivity of Assets | *13 | 47.4% | 47.1% | 50.6% | 50.9% | 44.0% | |

| Productivity of Labor | million yen | *14 | 18.7 | 18.8 | 21.6 | 20.8 | 20.4 | |

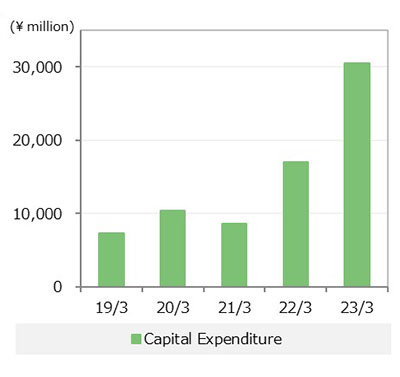

| Others | Capital Expenditure | million yen | 7,338 | 10,342 | 8,596 | 17,046 | 30,489 | |

| Number of Shares Outstanding | thousand shares | 97,244 | 97,244 | 97,244 | 97,244 | 97,244 | ||

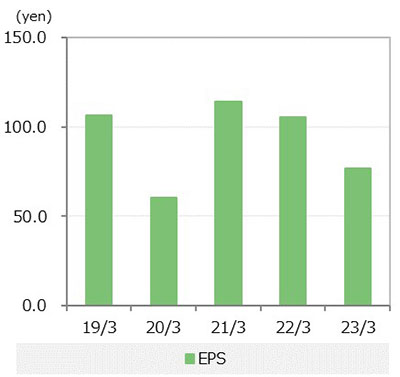

| EPS | yen | 106.4 | 60.6 | 114.2 | 105.6 | 76.7 | ||

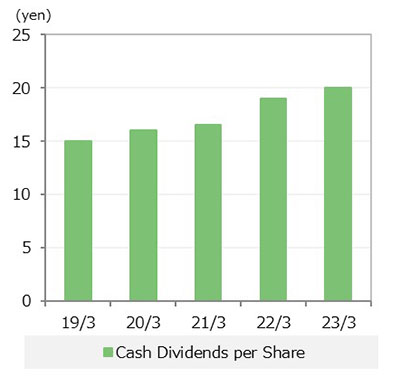

| Cash Dividends per Share | yen | 15.0 | 16.0 | 16.5 | 19.0 | 20.0 | ||

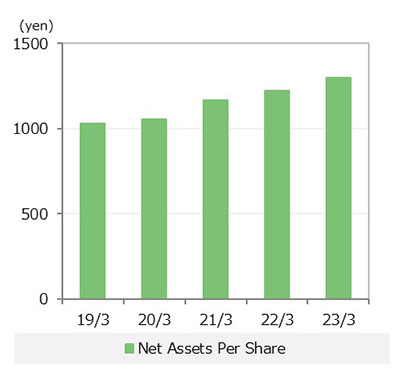

| Net Assets Per Share | yen | 1,028.6 | 1,054.1 | 1,165.0 | 1,223.2 | 1,297.9 |